If you are a military member or retired veteran looking to get a mortgage, one of the best available is the VA loan. Sponsored by the Department of Veterans Affairs, these mortgages offer incredible terms to give you a leg up in homeownership. Here are 8

Nov 17, 2022 | VA Loans

Not all homeownership looks like a single-family home with a white picket fence. There are all sorts of property types to help Americans realize the dream of becoming a homeowner. Condominiums, also known as condos, can be the perfect option for those who

Nov 15, 2022 | Purchasing a Home

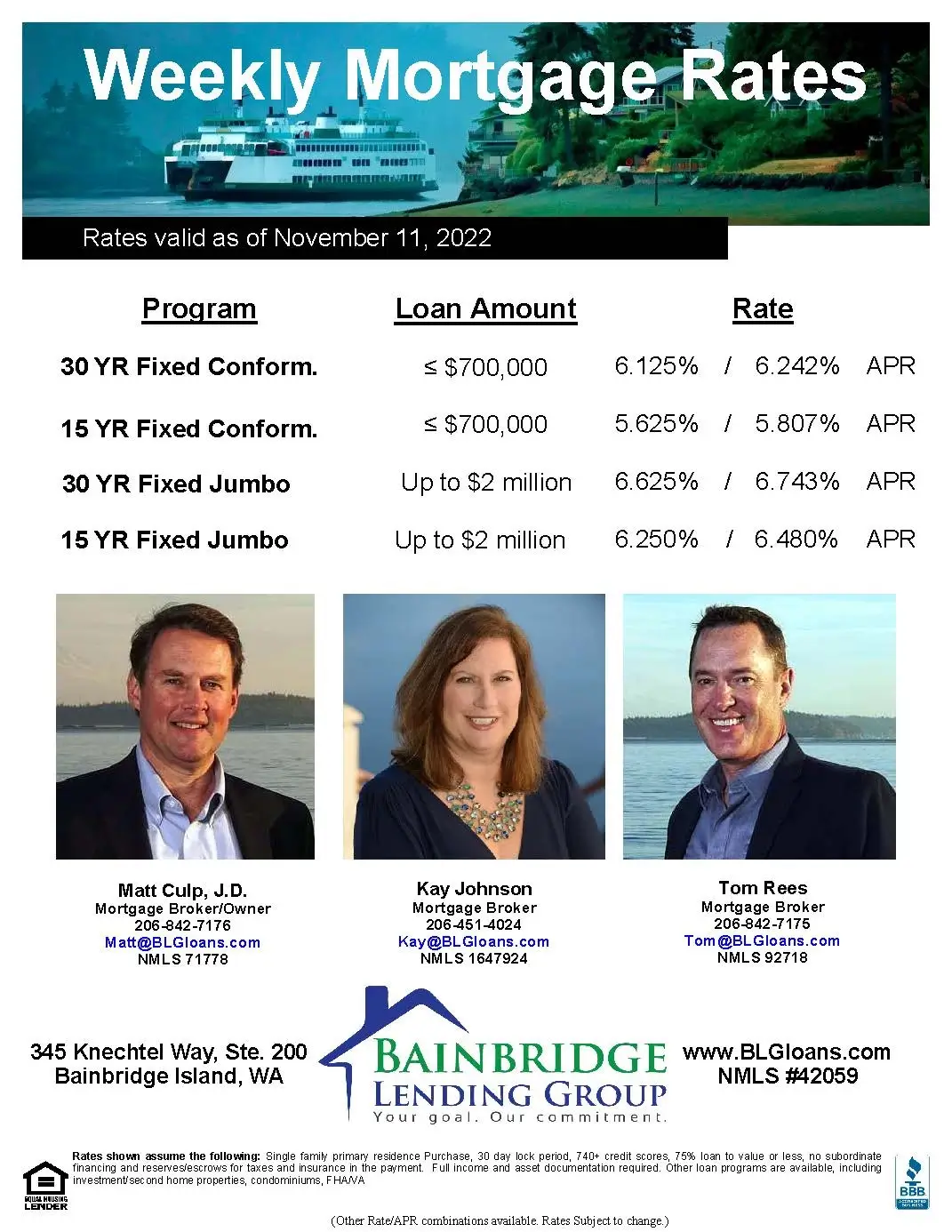

Here are the weekly rates as of November 11, 2022: 30 Year Fixed Conforming: 6.125% (6.242% APR) 15 Year Fixed Conforming: 5.625% (5.807% APR) 30 Year Fixed Jumbo: 6.625% (6.743% APR) 15 Year Fixed Jumbo: 6.250% (6.480% APR) For the rate sheet PDF

Nov 12, 2022 | Interest Rates Fixed Rate Mortgages Mortgage Jumbo Loans

Today, we honor all American Veterans who have serviced in the US Armed Forces. Your selfless service and sacrifice have brought honor to our great nation. We thank you for your service, your bravery, your love of God and Country, your selfless sacrifice,

Nov 11, 2022 |

If you qualify for a VA Loan, you will get some of the best mortgage terms and rates in the industry, including 0% down payments and no minimum credit score. However, starting the process for any home loan can be daunting. One of the first things you can

Nov 10, 2022 | VA Loans

Buying a vacation home can be an excellent investment, whether you are planning to use it exclusively as your own private escape or if you plan to rent it out for some extra income, or some combination of the two. However, purchasing a second home is a we

Nov 08, 2022 | Purchasing a Home