If you are ready to refinance your current loan, there are actually several types to choose from. The right one for you will depend on your purpose for getting a new loan and your eligibility for specialty programs. Here are the most common types and how

Jan 10, 2023 | Refinancing a Home

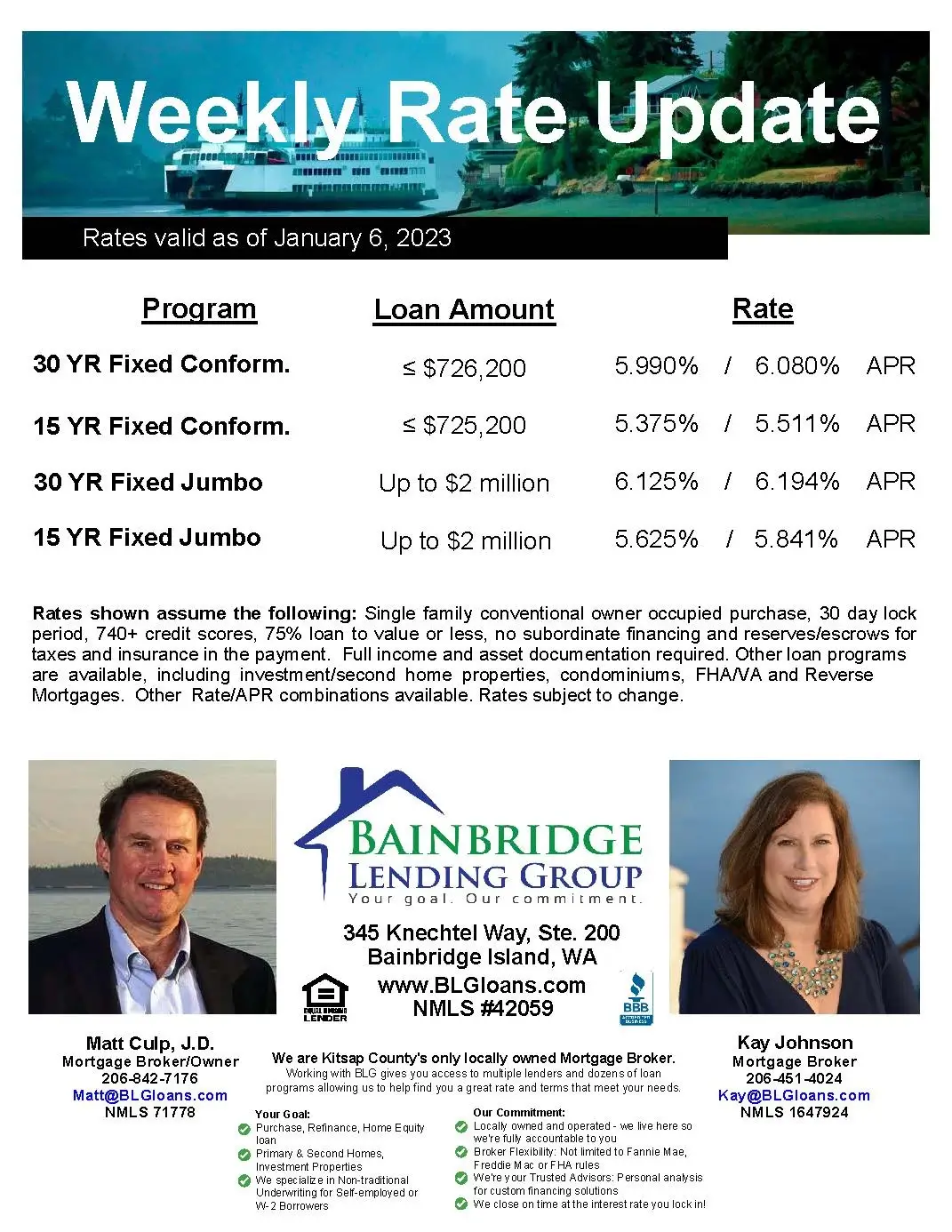

Here are the weekly rates as of January 6, 2023: 30 Year Fixed Conforming: 5.990% (6.080% APR) 15 Year Fixed Conforming: 5.375% (5.511% APR) 30 Year Fixed Jumbo: 6.125% (6.194% APR) 15 Year Fixed Jumbo: 5.625% (5.841% APR) For the rate sheet PDF,

Jan 09, 2023 | Interest Rates Fixed Rate Mortgages Mortgage Jumbo Loans Conventional Loans

When you are ready to buy a home, you may hear your mortgage lender start talking about your debt-to-income ratio, or DTI. While you may not have heard that term before, it is actually a very important number when it comes to figuring out if you can qual

Jan 05, 2023 | Credit

The past several years of housing boom, spurred on by the lowest mortgage rates in history and record-setting home demand, have likely seen their end. As U.S. inflation reached uncomfortable levels of inflation by early-2022, potential buyers started pull

Jan 03, 2023 | Purchasing a Home

It's a new day and a New Year and we want to wish you a Happy New Year! To all of our clients, partners, family and friends - you helped make 2022 a great year for us and we want to thank you for sharing your time and trust with us this past year. Whateve

Jan 01, 2023 |

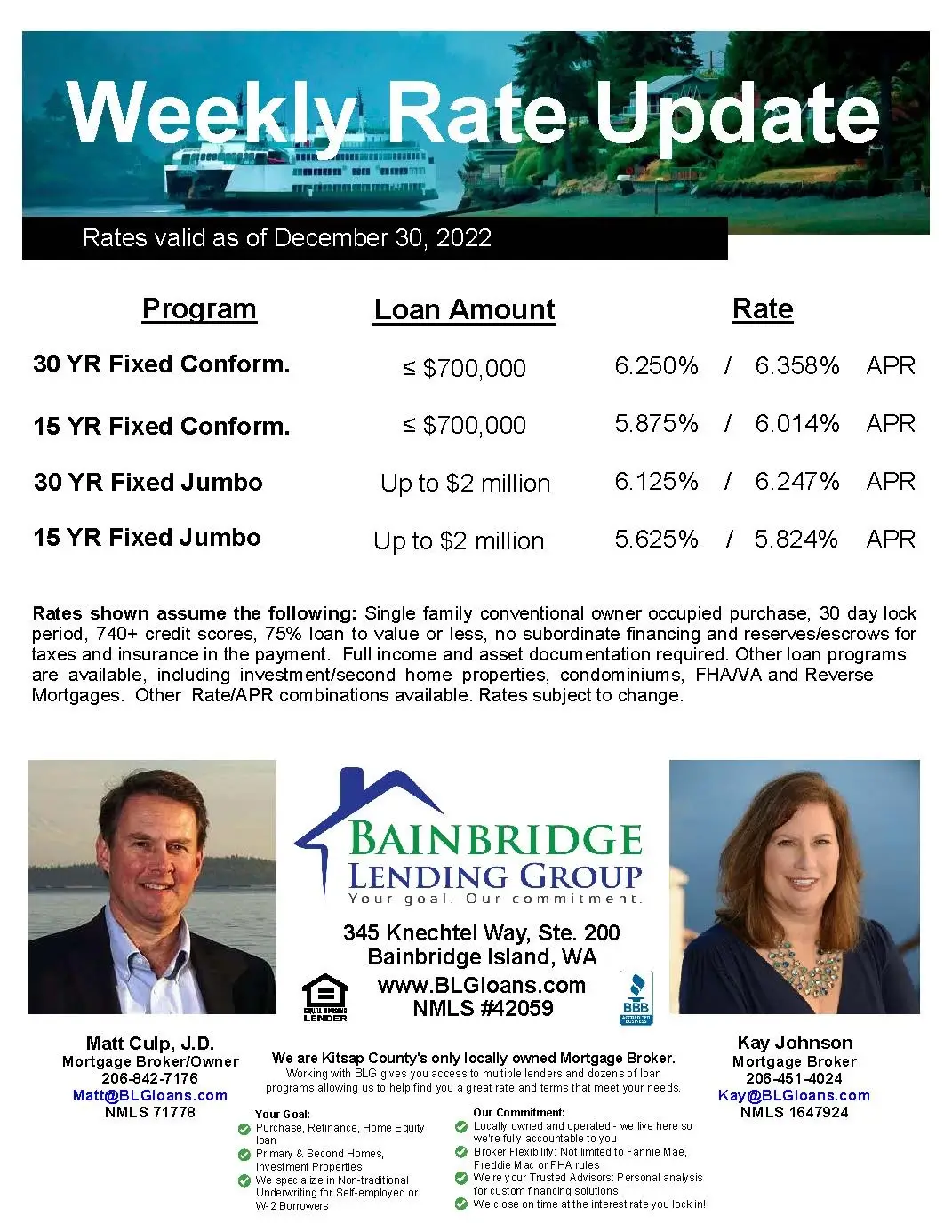

Here are the weekly rates as of December 30, 2022: 30 Year Fixed Conforming: 6.250% (6.358% APR) 15 Year Fixed Conforming: 5.875% (6.014% APR) 30 Year Fixed Jumbo: 6.125% (6.247% APR) 15 Year Fixed Jumbo: 5.625% (5.824% APR) For the rate sheet PDF

Dec 31, 2022 | Interest Rates Fixed Rate Mortgages Conventional Loans Mortgage Mortgages Jumbo Loans Weekly Rate Update