It's a new day and a New Year and we want to wish you a Happy New Year! To all of our clients, partners, family and friends - you helped make 2022 a great year for us and we want to thank you for sharing your time and trust with us this past year. Whateve

Jan 01, 2023 |

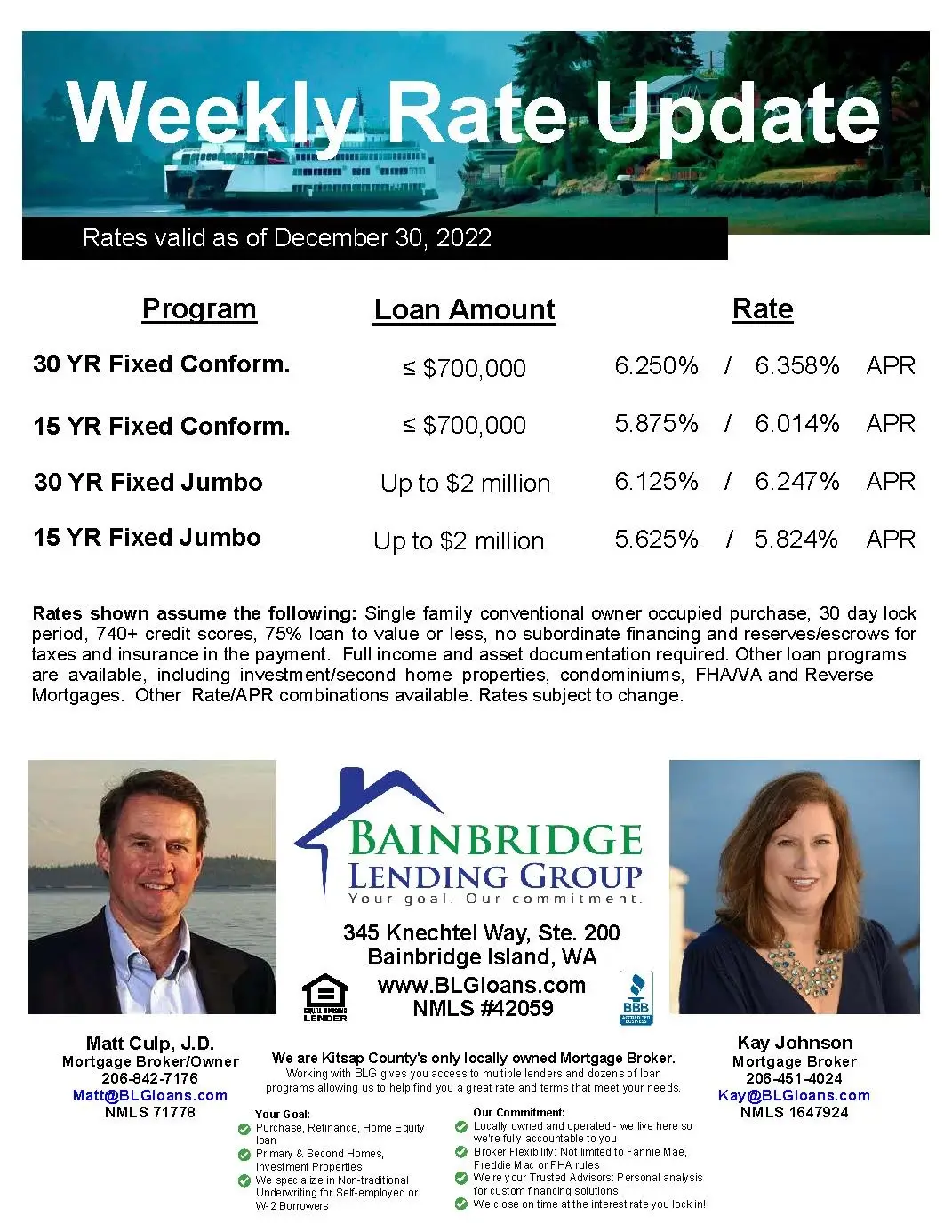

Here are the weekly rates as of December 30, 2022: 30 Year Fixed Conforming: 6.250% (6.358% APR) 15 Year Fixed Conforming: 5.875% (6.014% APR) 30 Year Fixed Jumbo: 6.125% (6.247% APR) 15 Year Fixed Jumbo: 5.625% (5.824% APR) For the rate sheet PDF

Dec 31, 2022 | Interest Rates Fixed Rate Mortgages Conventional Loans Mortgage Mortgages Jumbo Loans Weekly Rate Update

Buying a home is one of the biggest and most important financial decisions most people will make in their lifetimes. It is no wonder then that people want to be sure they are truly ready for the purchase. Here is a list of 6 ways to know that you have suf

Dec 29, 2022 | Purchasing a Home

With today’s rising interest rates and high home prices, buying a home takes some planning and forethought. Mistakes can be costly, like getting a mortgage higher than you can afford or getting stuck in a neighborhood or house you actually don’t like. Her

Dec 27, 2022 | Purchasing a Home

With Christmas fast-approaching, all of us at Bainbridge Lending Group, LLC would like to wish you a Merry Christmas! We hope that this week you'll be surrounded by family, friends and loved ones while enjoying time together and making great memories. It

Dec 22, 2022 |

Since buying a home is one of the biggest financial investments most people ever make, if you're are not careful, you can get in over your head. This can result in a status of being “house poor,” or spending way more on housing costs than you can afford.

Dec 20, 2022 | Refinancing a Home