You’re in the home stretch: you’ve found a great home, made an offer and been accepted. You’ve gone through the home inspection appointments and resolved any issues and now you’re waiting for the mortgage underwriting process to wrap up before you finally

Jan 17, 2023 | Purchasing a Home

If you are an active-duty or retired service member, you are likely familiar with the many benefits of buying a home with a VA loan. The Department of Veterans Affairs guarantees mortgage loans that have some of the best rates and terms on the market. But

Jan 12, 2023 | VA Loans

If you are ready to refinance your current loan, there are actually several types to choose from. The right one for you will depend on your purpose for getting a new loan and your eligibility for specialty programs. Here are the most common types and how

Jan 10, 2023 | Refinancing a Home

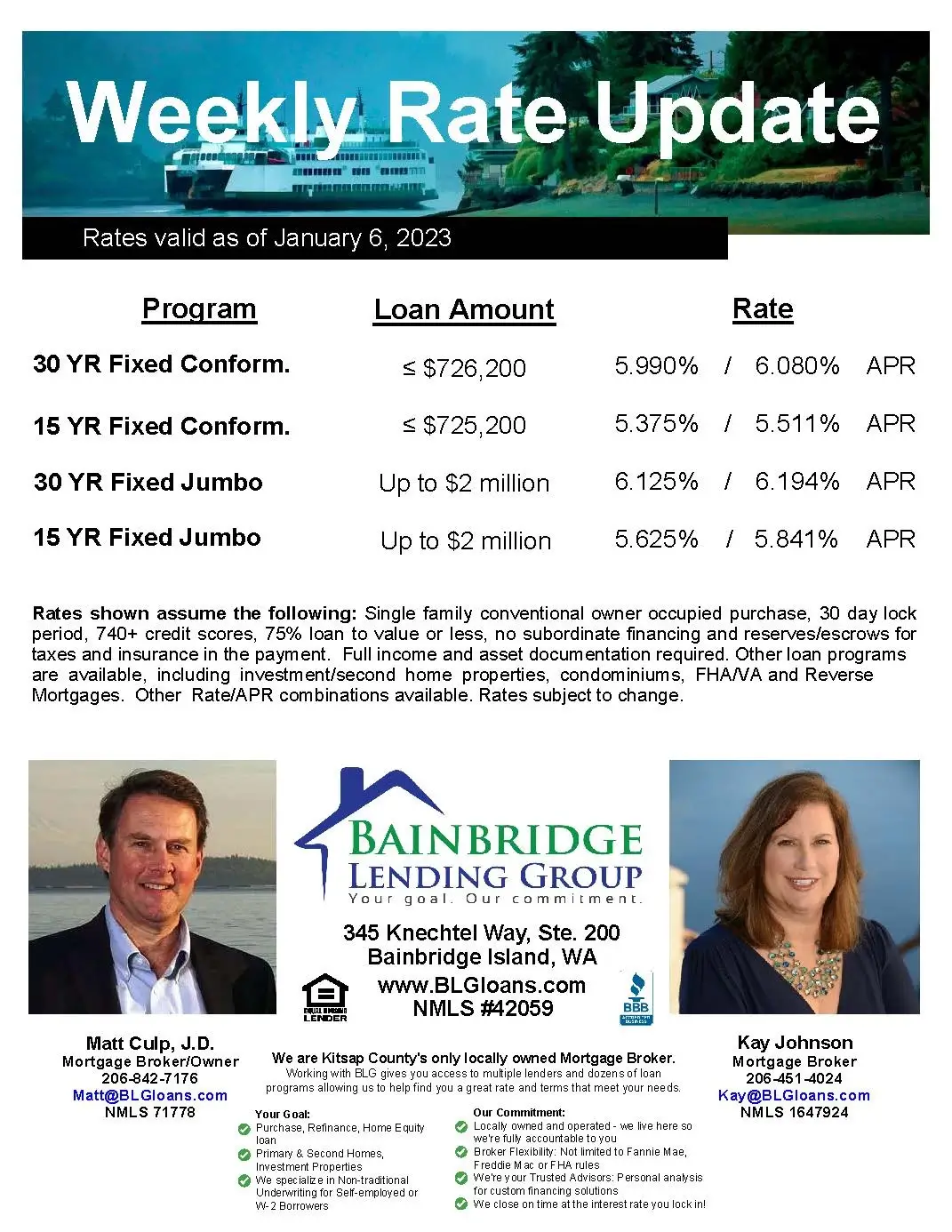

Here are the weekly rates as of January 6, 2023: 30 Year Fixed Conforming: 5.990% (6.080% APR) 15 Year Fixed Conforming: 5.375% (5.511% APR) 30 Year Fixed Jumbo: 6.125% (6.194% APR) 15 Year Fixed Jumbo: 5.625% (5.841% APR) For the rate sheet PDF,

Jan 09, 2023 | Interest Rates Fixed Rate Mortgages Mortgage Jumbo Loans Conventional Loans

When you are ready to buy a home, you may hear your mortgage lender start talking about your debt-to-income ratio, or DTI. While you may not have heard that term before, it is actually a very important number when it comes to figuring out if you can qual

Jan 05, 2023 | Credit

The past several years of housing boom, spurred on by the lowest mortgage rates in history and record-setting home demand, have likely seen their end. As U.S. inflation reached uncomfortable levels of inflation by early-2022, potential buyers started pull

Jan 03, 2023 | Purchasing a Home