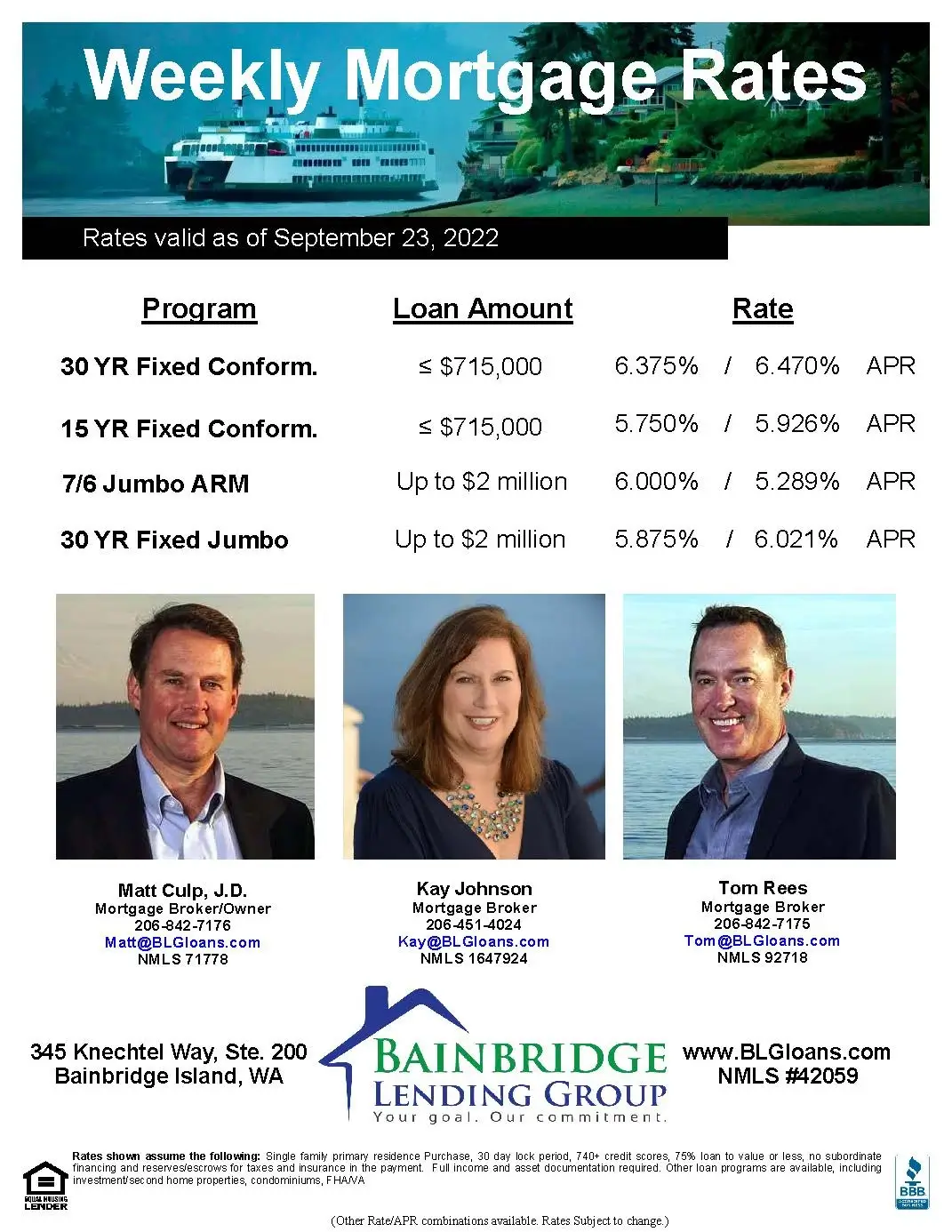

Here are the weekly rates as of September 23, 2022:

-

- 30 Year Fixed Conforming: 6.375% (6.470% APR)

- 15 Year Fixed Conforming: 5.750% (5.926% APR)

- 7/6 Jumbo ARM: 6.000% (5.289% APR)

- 30 Year Fixed Jumbo: 5.875% (6.021% APR)

For the rate sheet PDF, click here.

Hi there. Rates ended the week up again. I sound like a broken record. The 10 year bond topped out at 3.69% up from 3.46% last week. The Freddie Mac rate reached another high of 6.29% up from 6.02%. Attached is our weekly rate sheet. Feel free to pass it on to anyone you know who could use our assistance.

The Fed met this week and raised their rate by another .75%, the third straight increase of that size. And they said there would be more increases in the coming months and then likely hold rates at that level for most of next year. The markets didn’t like these comments of course and so rates moved up and the stock market feel below 30k for the first time in almost two years. Oil dropped below $80 a barrel for the first time since January. And the inversion spread between the 2 year and 10 year bonds hit its widest gap in over three years at .52%. Meaning you will make over half a percent more in interest loaning money to the government for two years versus 10 years—not the normal interest rate curve. All of this suggests the markets are even more concerned the Fed will push the economy into a recession sooner than later. And honestly that is what the Fed wants if that is what it takes to get inflation back down to their target 2.0% or so. Who will blink first?

The upside is if we do start to see unemployment edge up and inflation start to ebb then it is possible the Fed will start to cut rates sooner than later next year. That timeline is what is now the big debate. Of course right now we all have to deal with interest rates that have not been seen since before the housing crash in 2007-2008. But if housing prices start to moderate that could help buyers.

Again, we have the 2-1 interest rate buydown program that can benefit both the buyer and seller. Attached is our flyer explaining how it works and what the math looks like. Feel free to pass this on to your clients—buyers and sellers—and let us know if you have any questions about how it works.

We are around all weekend should you or our clients need our assistance. Thanks and enjoy the first few days of fall.