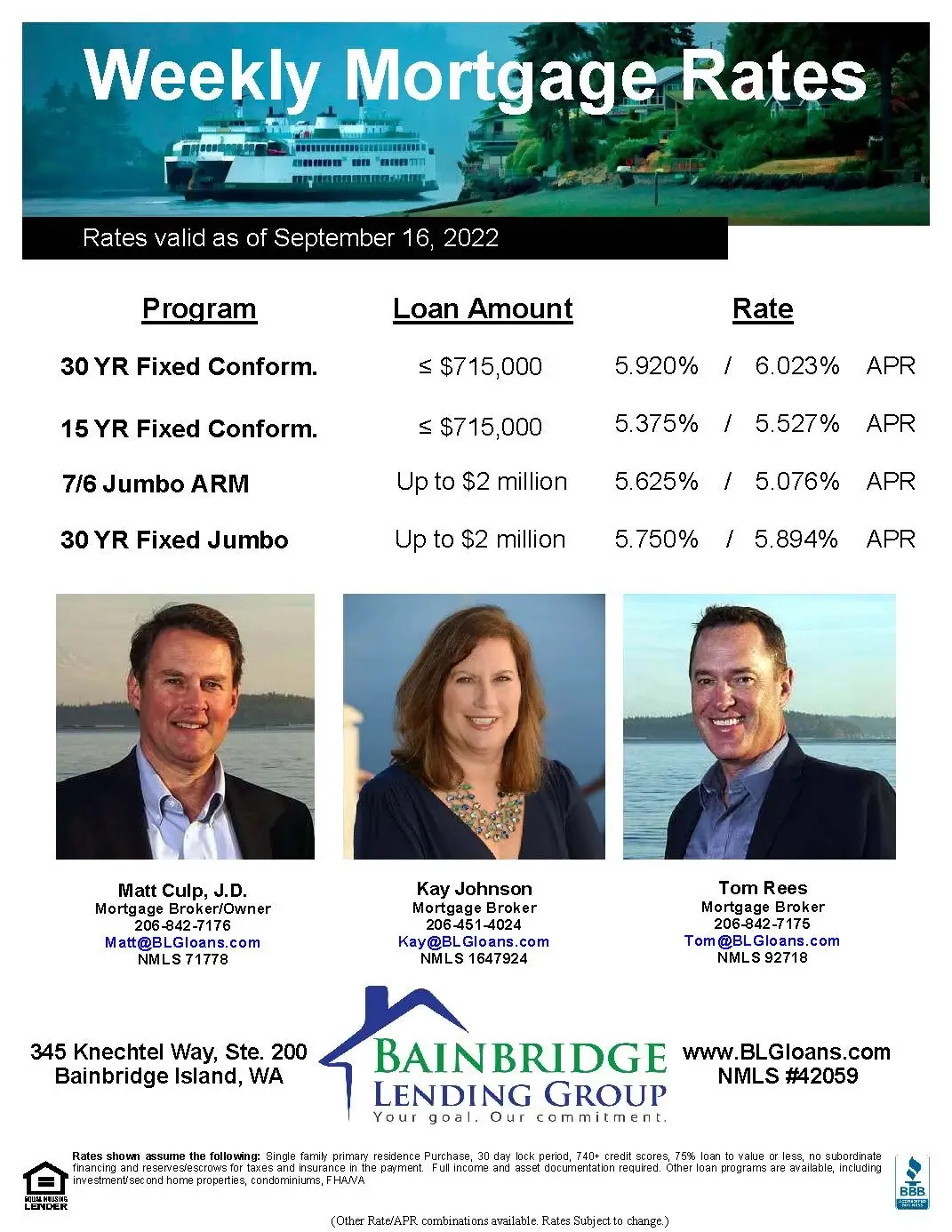

Here are the weekly rates as of September 16, 2022:

-

- 30 Year Fixed Conforming: 5.920% (6.023% APR)

- 15 Year Fixed Conforming: 5.375% (5.527% APR)

- 7/6 Jumbo ARM: 5.625% (5.076% APR)

- 30 Year Fixed Jumbo: 5.750% (5.894% APR)

For the rate sheet PDF, click here.

Hi there. Happy Saturday. Rates ended the week up again. The 10 year bond ended at 3.46% up from 3.32% last week. The Freddie Mac 30 year fixed rate hit a 14 year high of 6.02% up from last week’s 5.89%. We are now at the highest rates we have seen since 2008. Attached is our weekly rate sheet. Feel free to pass it on to anyone you know who could use our assistance.

Main driver again was inflation pressures and that came in the form of hotter than expected August CPI numbers. This adds further support to the a Fed increase at next week’s meeting of at least another .75%. And likely more hikes in the coming months. The only upside is that markets are expecting this now and so the rates and yields reflect this. Absent more bad (not) inflation data we could see markets start to settle back a bit in the coming months. But let’s get past the Fed’s next meeting.

We have access to a new loan program and it could be beneficial to both buyers and sellers as the market shifts more toward a balanced buyer/seller negotiation position and as rates continue to hit new highs. It is called a 2-1 buy down and is funded by the seller or agents (not by the buyer directly). This is not the same as a seller credit of say $10k to “buy down the rate.” This program is a bit more complex than that approach but it has a bigger bang for the buck. For example, if the going rate was 6.0% on the 30 year fixed then the buyer would qualify at 6.0%, but in year one of the loan their rate would be 4.0% and then in year two it would be 5.0% and then in year three going forward it would be 6.0%. This is a pretty good savings over that two year period and if we see rates settle back down in the next year or two this could be a good stop gap given how high rates are now. Of course 6.0% is not really that high historically, but 14 years since we last hit that level is a long time.

If you’d like to know more about how this works, how it is paid for, why a seller or agent would want to do this and how it is worked into the offer and contract just reach out to us and we can give you the particulars and run a scenario or two.

We are around the rest of the weekend should you need our assistance. Thanks.