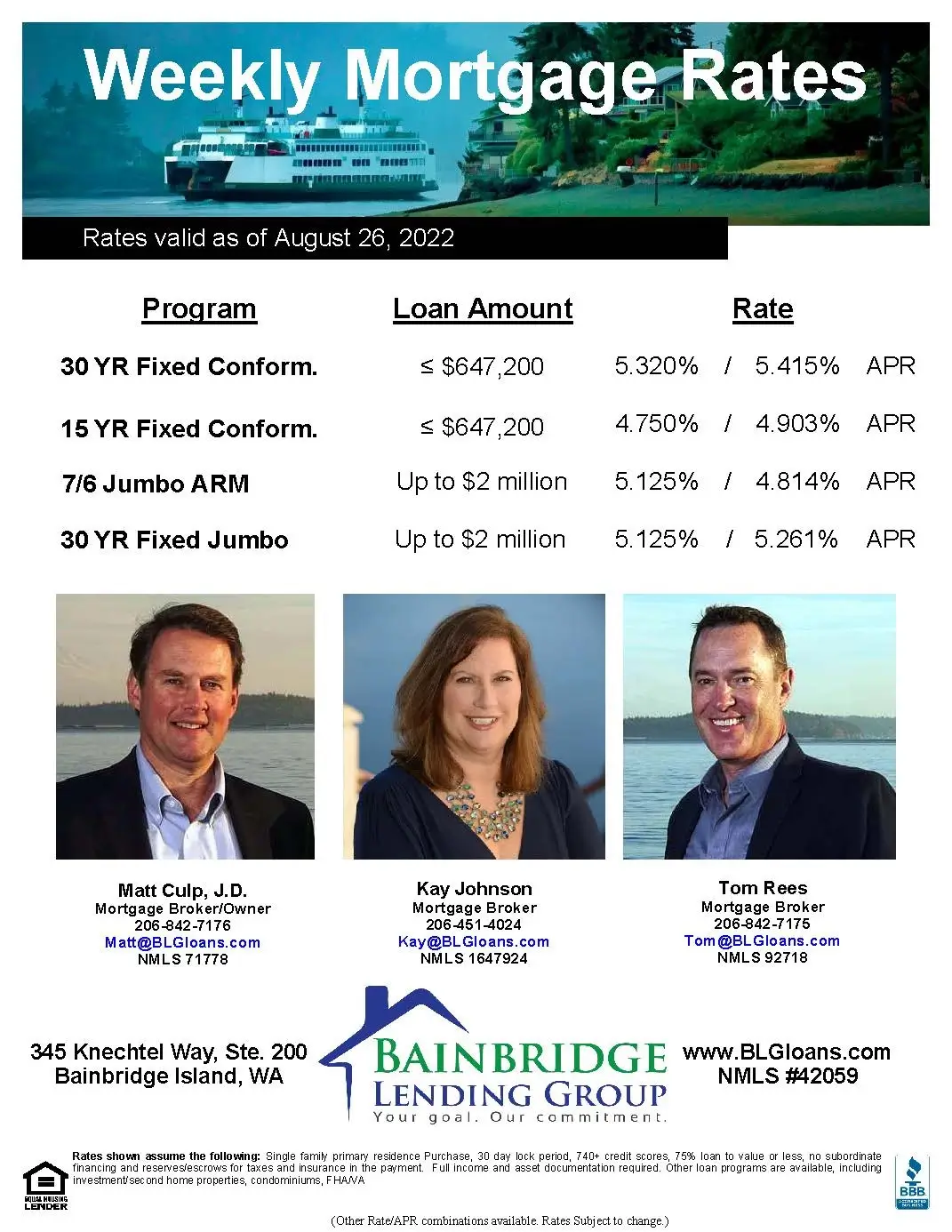

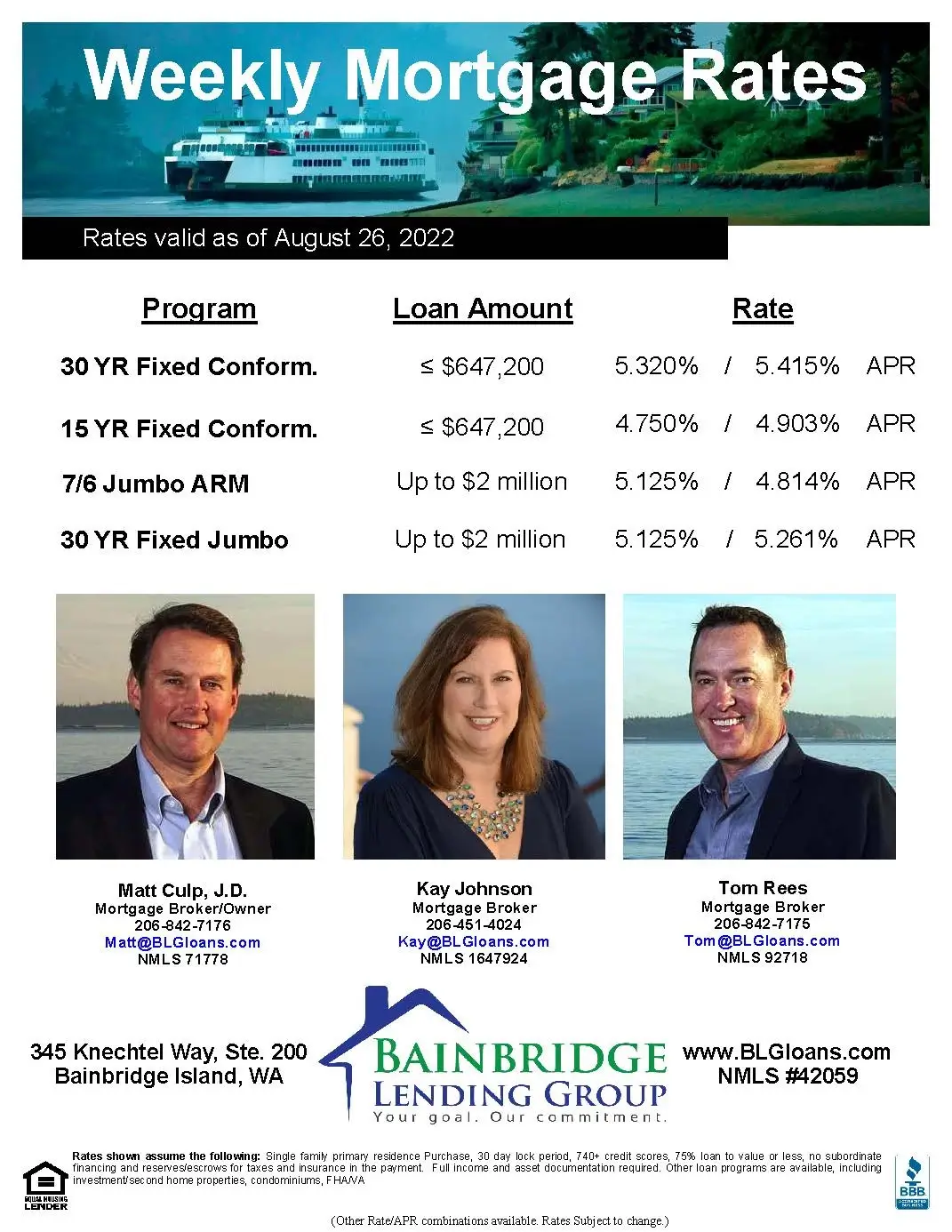

Here are the rates for today, August 26, 2022 at Bainbridge Lending Group:

-

-

30 Year Fixed Conforming: 5.320% (5.415% APR)

-

15 Year Fixed Conforming: 4.750% (4.903% APR)

-

7/6 Jumbo ARM: 5.125% (4.814% APR)

-

30 Year Fixed Jumbo: 5.125% (5.261% APR)

-

For the rate sheet PDF, click here.

Rates ended the week up again. The 10 year bond moved up slightly to 3.03% from last week’s 2.98%. The Freddie Mac 30 year fixed rate jumped to 5.55% from 5.13%. We are back near the highs of June. Our rate sheet is attached. Feel free to pass this on to anyone you know who could use our assistance.

The market moves this week were in anticipation of Fed chairman Powell’s remarks at the annual Jackson Hole conference where global central bankers, economists and policy makers gather to solve the world’s problems. OK, I added the last part! Today Chair Powell said very clearly, in a fairly short speech, that the Fed’s job is to maintain price stability (read get inflation down). And that to accomplish this it will take time and will cause some pain to households and businesses as the economy slows and unemployment increases as they keep raising their rates to get inflation down. But they will still be data dependent, so we will be watching the CPI and job reports in the coming weeks and months.

The markets understood the comments to mean the Fed will continue to raise rates, perhaps by .75% again next month, and not let up until they see inflation data points steadily dropping for a period of time. Not just over one month. The Dow dropped over 1000 points. The bond market was up and down today but ended about flat as it digested the Fed comments—will this lead to a recession or not and how high do rates have to go to get inflation down? Not clear now after the speech.

So what does this mean to mortgage rates? I think it means we are headed into a period where rates will stay elevated until inflation really comes down and/or we end up in a recession. Once that happens we could see rates come back down as the Fed starts to cut rates to pull the economy out of the recession. And we will likely see home prices come down and more inventory hit the market over the next 6 months. Even in the mid-5.0% range for a conforming 30 year fixed rates are still pretty low historically. If a buyer needs a home and they can afford the payment then this fall may be a good time to buy. Then if rates drop next year sometime and a refi makes sense, they can pursue that. House prices could move back up once rates drop back down as there is still a lot of demand out there. Seems like a lot of reverse psychology going on but that is how a lot of our economy works.

We are around all weekend should you need our assistance. And Go Hawks! Thanks.