LTV Defined The loan-to-value ratio is the comparison of the mortgage balance to the market value of the home. It is calculated by dividing your loan amount by the value of the property you currently own or the one you want to buy. For example, you want t

Sep 22, 2022 | Purchasing a Home

It's no secret that mortgage interest rates have risen this year. Rates have risen almost four percentage points in less than a year. That kind of rate increase can be stressful for home buyers? But what about home sellers? How do increasing rates affect

Sep 20, 2022 | Interest Rates

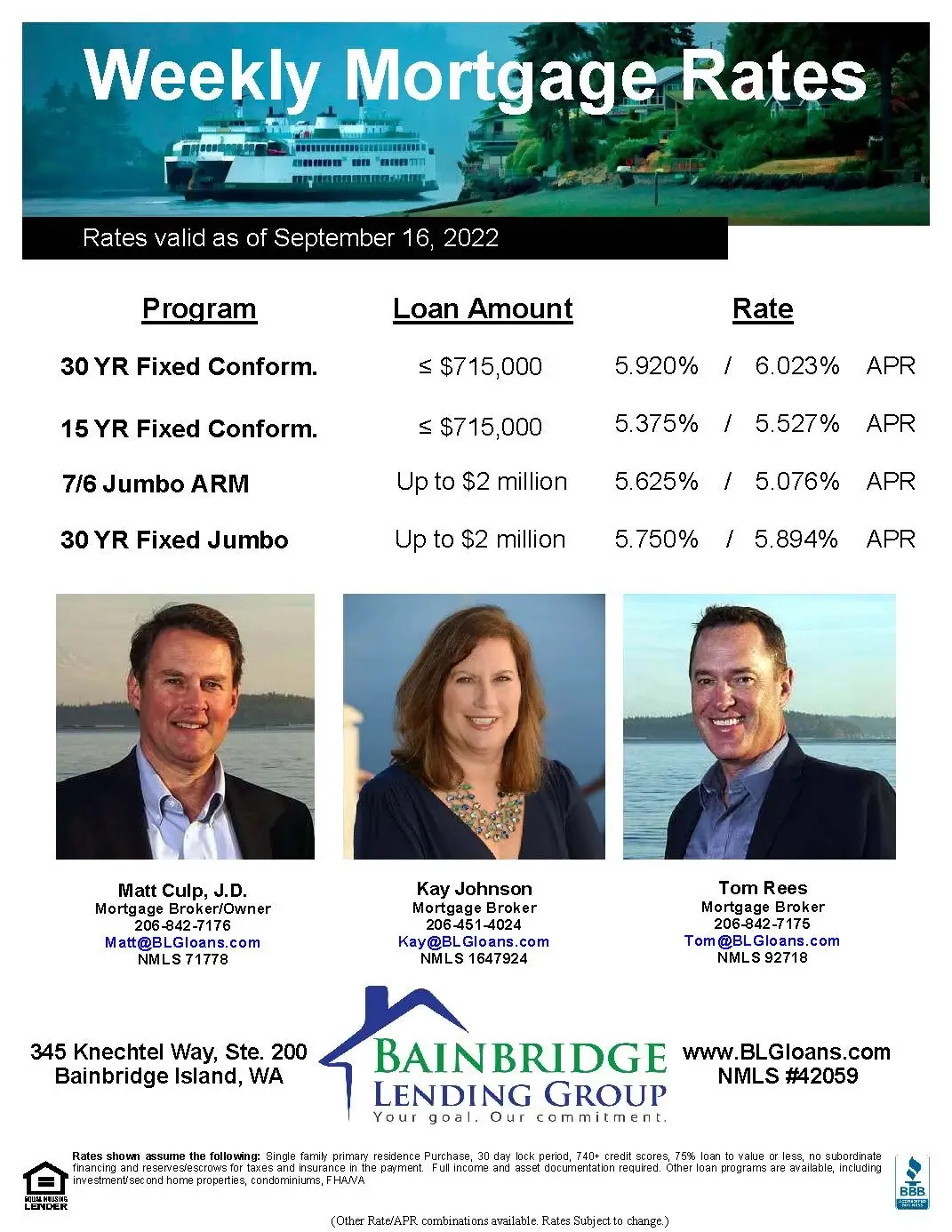

Here are the weekly rates as of September 16, 2022: 30 Year Fixed Conforming: 5.920% (6.023% APR) 15 Year Fixed Conforming: 5.375% (5.527% APR) 7/6 Jumbo ARM: 5.625% (5.076% APR) 30 Year Fixed Jumbo: 5.750% (5.894% APR) For the rate sheet PDF, click

Sep 18, 2022 | Interest Rates Fixed Rate Mortgages Adjustable Rate Mortgages Jumbo Loans Mortgage

If you have a VA loan as a military homeowner, you know that these loans offer some of the best rates and terms on the market. With no down payment requirements, and low credit score qualifications, VA loans provide veterans, active-duty military and thei

Sep 15, 2022 | VA Loans

In today’s housing market with sparse inventory, many people are opting for new builds or even to build their own custom homes. If you’re interested in building on a piece of property but unsure how to afford the cost until you sell your current home, a

Sep 13, 2022 | Purchasing a Home

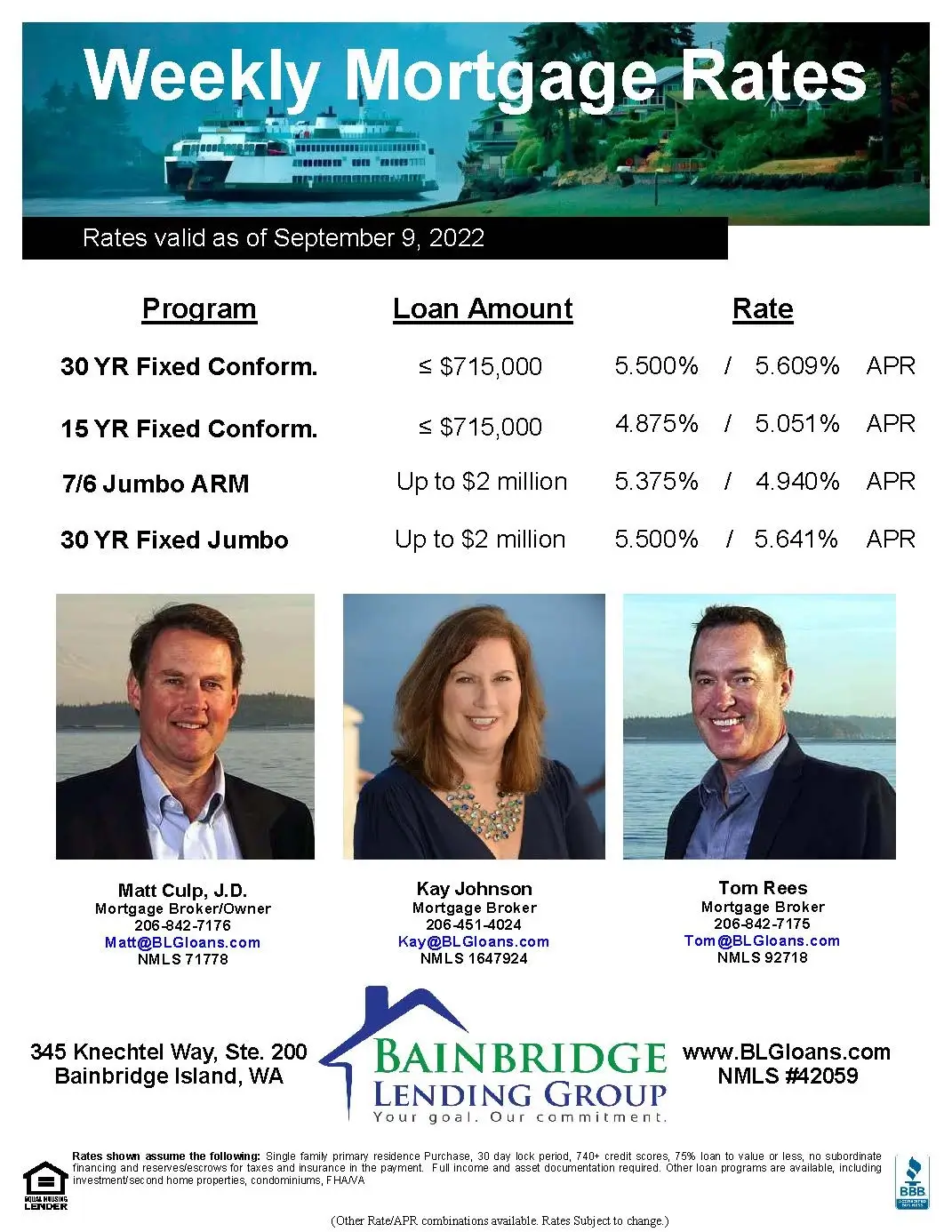

Here are the weekly rates as of September 9, 2022: 30 Year Fixed Conforming: 5.500% (5.609% APR) 15 Year Fixed Conforming: 4.875% (5.051% APR) 7/6 Jumbo ARM: 5.375% (4.940% APR) 30 Year Fixed Jumbo: 5.500% (5.641% APR) For the rate sheet PDF, clic

Sep 09, 2022 | Interest Rates Fixed Rate Mortgages Adjustable Rate Mortgages Mortgages Jumbo Loans